Miyana Epps

Real Estate Investor and Multifamily Syndicator

My name is Miyana Epps. I am a proud Bay Area native and the owner of Ask M.E. Investments. I have over 20 years of real estate experience which includes lending, wholesaling, rehabbing, interior design, consulting and being a California licensed agent. I currently have ownership interest in 244 multifamily units. With a focus on raising capital and investor relations, my experience as a passive investor has taught me the importance of communication and transparency. My award-winning background in corporate sales and marketing has given me the ability to grow and maintain vital investor relationships which are the lifeline of my business.

My mission is to enable and inspire others to build wealth and realize financial freedom through real estate. I am super passionate about promoting financial literacy and encouraging the next generation to have a money mindset. I’ve had so many great mentors pour into me and I’d like to do whatever I can to pay it forward. Looking forward to networking with you all!

Subscribe to our Investor Newsletter

Benefits of Apartment Investing

Completely Passive Investments

You should be earning like a landlord, not working like one. Our investments are passive, giving you the potential to earn income without the maintenance or operational responsibilities of owning a building.

Diversification

Historically, private real estate has not been directly correlated with the stock market, which may mitigate your exposure to market volatility and improve portfolio stability.

Economies of Scale

Own more units to reduce your risk. Reduce expenses by consolidating more units under one roof. Enjoy the value of owning large assets without having to buy the entire building. Invest in large-scale real estate projects with other investors, without having to foot the entire bill.

Our Process

Evaluation

We identify the strongest investment markets in the country based on our predetermined criteria. Next we locate an asset with "value-add" potential. We will perform a simple evaluation to see if the asset warrants further underwriting. After a deeper dive into the specifics of the property, we will make a determination on whether or not to proceed with a Non-Binding letter of intent.

Due Diligence/Acquisition

Once the contract is accepted by all parties, we will proceed with due diligence. Due diligence includes but is not limited to a physical walk of the property including all units, a review of all financial documentation, leases and meeting with local city officials to include their input on tax savings, permitting our proposed business plan.

Value-add Strategy

We specifically look for distressed properties that have an opportunity for us to improve performance metrics by lowering expenses, increasing revenue, or both. This allows us to provide greater returns to our investors.

Asset Management

We will conduct on going asset management to ensure all properties are properly maintained to our strict standards. We will oversee and verify that property managers are continually operating at the highest level. We conduct meetings with our management and maintenance teams to review service requests, unit turns, inventory, staffing levels and KPI’s on regular basis. In addition, conducting onsite visits and interviewing random tenants to confirm overall satisfaction with their rental experience.

Cash Buyer's List:

Get access to off-market single family and multifamily deals priced below market rate!

Sponsor our Network:

Add value to our community of thousands while elevating your brand and platform through sponsorship.

Join our Meetup:

Sign up to be invited to virtual and in person educational/networking sessions. Connect with other like-minded individuals and potential partners!

Passive Investing:

Get access to lucrative multifamily investment opportunities- grow your portfolio without lifting a finger!

Get In Touch

Email: Miyanaepps@askmeinvestmentsllc.com

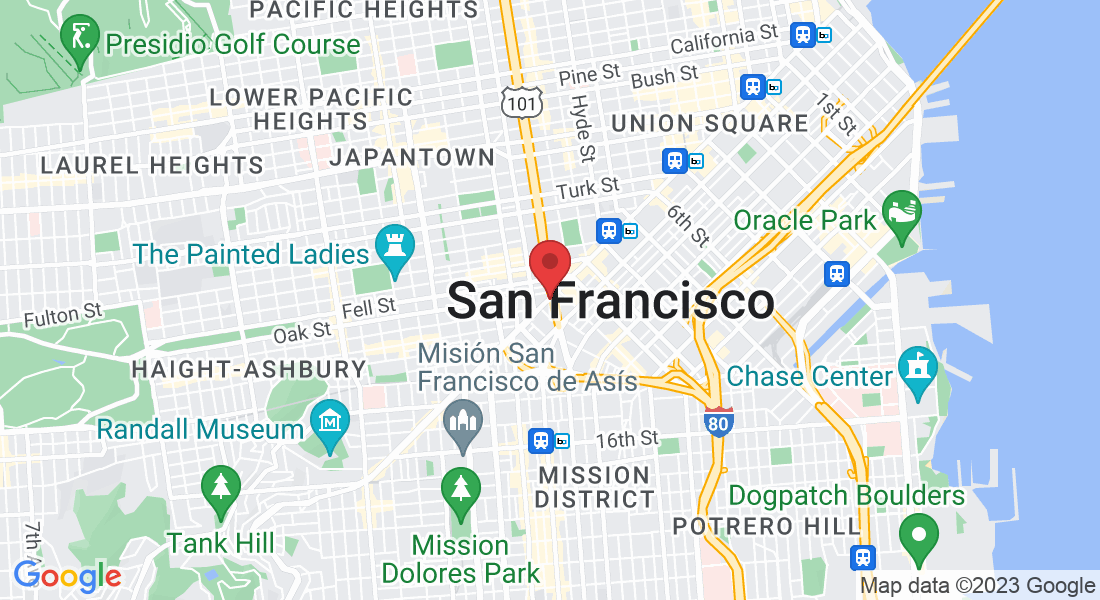

Address

Office: San Francisco, California

Assistance Hours

Mon – Sat 9:00am – 8:00pm PST

Sunday – CLOSED

Phone Number:

(510)-813-9700

Office: San Francisco

Call (510)-813-9700

©2022, Copyright All Rights Reserved